Zurich Kotak Health Insurance

Zurich Kotak Health Insurance Company offers a comprehensive range of health insurance plans. These plans fulfil the needs of different sections of so...Read More

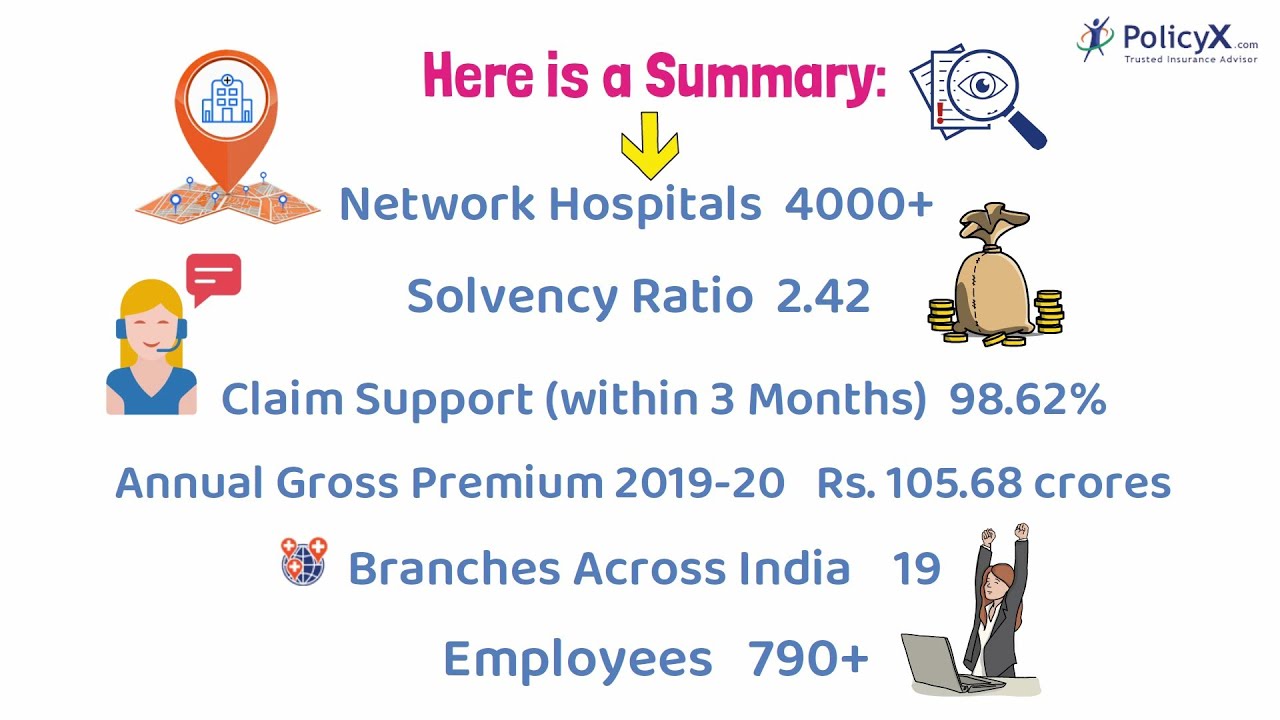

Network hospitals

9450+

Claim settlement ratio

96.76%

Sum insured

Up to 25 L

No. of Plans

4Solvency Ratio

2.2

Pan India Presence

19+

Choose 1st Company

Choose 2nd Company

Compare

Best Selling Zurich Kotak Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual

Zurich Kotak Health Insurance Plans Eligibility Approximate Annual Premiums Zurich Kotak Group Accident Protect Plan Entry Age - 5 years to 65 Years

Sum Insured - Up to 25 LRs.

Zurich Kotak Accident Care Plan Entry Age - Minimum 5 years, Maximum 65 years

Sum Insured - Up to NARs. NA

-

Individual and Family Health Insurance

Zurich Kotak Health Insurance Plans Eligibility Approximate Annual Premiums Zurich Kotak Health Premier Plan Entry Age - Minimum 91 days, Maximum 25 years

Sum Insured - Up to 2 CrRs. NA

-

Group Health Insurance

Zurich Kotak Health Insurance Plans Eligibility Approximate Annual Premiums Zurich Kotak Group Health Care Policy Entry Age - 18-55 years

Sum Insured - Up to 5 LRs. NA

Key Features Of Zurich Kotak Health Insurance

Let us take a look at some unique features of top-selling Zurich Kotak Health Insurance policies:

For Individual

Zurich Kotak Group Accident Protect Plan

The Zurich Kotak Group Accident Care Plan offers accidental protection to individual insured members for any sort of medical expenses related to accidental injury, death, etc.

Why Do We Recommend This?

- Children education grant

- Accidental injury/ fatalities that require in-patient hospitalization

- Temporary, partial, and total disablement

For Individual and Family Health Insurance

Zurich Kotak Health Premier Plan

Zurich Kotak Health Premiere Plan is a comprehensive health insurance that covers in-patient hospitalization, daycare procedure treatments, ambulance services, and other basic healthcare expenses.

Why Do We Recommend This?

- Avail domiciliary hospitalization

- Maternity-related medical expenses cover

- Compassionate travel is covered

For Group Health Insurance

Zurich Kotak Group Health Care Policy

This plan is specially designed for the active customers of Kotak Mahindra Bank Limited to cover basic healthcare needs.

Why do we recommend this?

- Emergency ambulance cover

- Domiciliary hospitalization

- Obesity treatment unavailable

Recommended Videos

Why Choose Zurich Kotak Health Insurance?

Zurich Kotak Mahindra Health Insurance Company is famous for creating products that are flexible enough to meet the requirements of their varied customers. There are several benefits to choosing Zurich Kotak Mahindra Health Insurance as your health insurance partner.

- More than 11,200 networking hospitals across India

- 24X7 customer support for easy claim settlement

- Free health check-ups

- The claim settlement process is super fast and hassle-free

- Tax benefits under Section 80D of the Income Tax Act

Factors to Consider While Buying A Health Insurance Policy

Choosing a health insurance plan can be stressful and confusing for most people. But you need to have a clear idea of what a certain plan is offering and what they are covering. Once you are positive about the plan benefits, it becomes easier to make correct decisions. Let us check out some of the vital factors that you should consider before buying a health insurance policy:

-

Individual or Family Floater Plan

When choosing a plan your first step is to check whether your requirement is for yourself or your family. Most of the time family floater plans benefit those who want to secure their family as it is cheaper than the individual one.

-

Cover Amount

We all know that with growing inflation, medical expenses are also increasing day by day. Therefore, having health insurance will help hugely to meet the expenses. Also, it is necessary to choose a policy that offers maximum coverage amount for your health claims.

-

Co-Payment Clause

Every policy has some clauses you need to follow and a co-payment clause is one of those. This means that for every claim you make, you have to bear a certain percentage of the claim amount. So, you must check how much clause your policy is putting in.

-

Hospital Network

Always check the list of hospitals included in your policy. Remember the kinds of medical facilities and services you might need in the future.

-

Waiting Period

Look for the period you need to wait before claiming the reimbursement. Some policies put a waiting period on critical illness as well, you need to check for that too.

-

Lifetime Renewal

You may need healthcare when you grow old. So, look for a policy that provides lifetime renewal options.

-

Compare the Premiums

You should always choose the premium after comparing more than two policies. This thoughtful action will prevent you from paying a higher amount for lesser claims.

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2635 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?